|

|

Guest Book | Pages & Links |

Report To Employees

The Glenn L. Martin Company

Baltimore [.PDF]

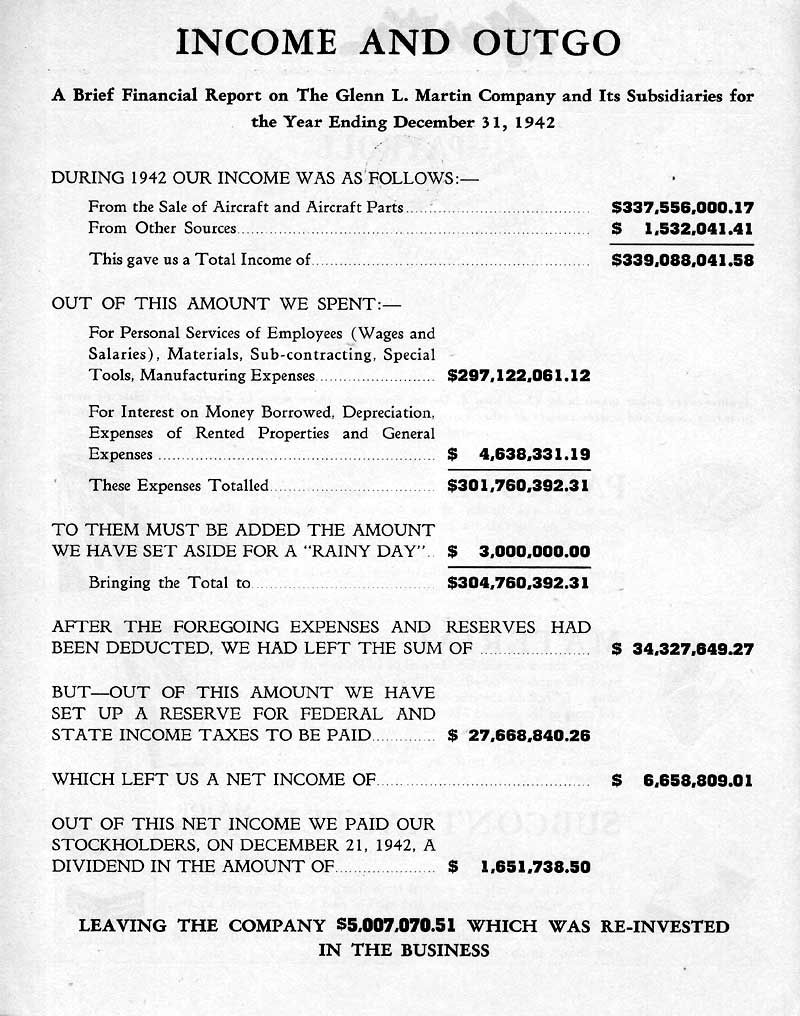

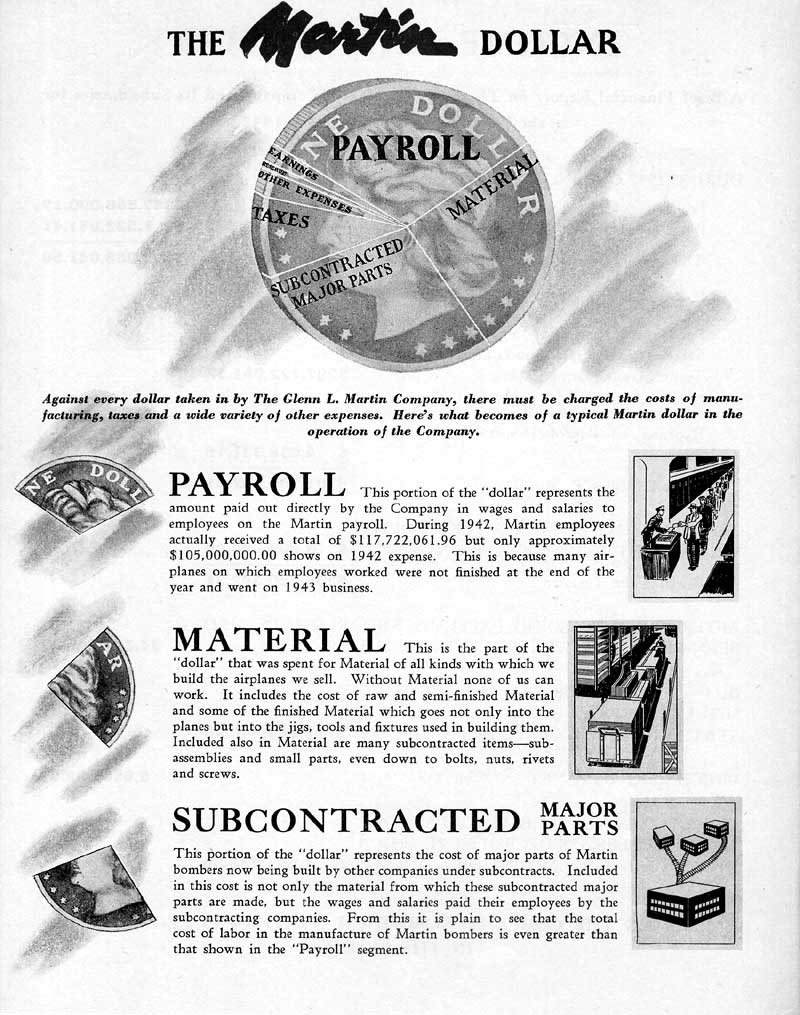

REPORT TO EMPLOYEES THE GLENN L. MARTIN COMPANY BALTIMORE March 31, 1943. Fellow Employees:- The Management has just issued the Company's annual report for 1942 to stockholders. In order that you may also understand how the Company's funds were used in 1942, a review of this financial report is set forth on the following pages. You will be interested to know that the amount paid out to employees during 1942 for personal services-wages and salaries-reached the total of $117,722,061.96-over 2 3/4 times the corresponding figure for 1941. You will also want to know what portion of the total income of the Company this figure represents, what was spent for taxes, materials, and other expenses, and how much was paid to stockholders and put away for the future. I believe that a thorough understanding of these facts by Martin employees will make for increased confidence in the Company. As to what is being done in preparation for the future, I would like to quote directly from the President's report to the stockholders in which I said: "The war's end will bring new problems and new adjustments in the Company's operations. The Management is laying plans designed to protect the interests of the employees, the stockholders and the Nation. Current consideration of post-war conditions points to the cargo-carrying airplane as an instrument of great national as well as international importance. The Company's long experience in designing and building large aircraft will be useful in that field. Similarly, the Company has sought to develop new devices the application of which is not limited to the aircraft field. Substantial progress has been made in that direction." As to the present, I quote again from the report to stockholders: "The year in review has further enlarged the Company's field of service to our nation at war. All energies are devoted to winning the ultimate victory. The thousands of Martin men and women who now serve with us on the 'production front' deserve equal praise and commendation with those 8,700 Martin workers who have already left to join their fellow-citizens on the 'fighting fronts'. Both groups are necessary, both participate in every battle: the first, by the products of their hands and brains; the second, by personal service facing the enemy." Sincerely, Glenn L. Martin President  INCOME AND OUTGO A Brief Financial Report on The Glenn L. Martin Company and Its Subsidiaries for the Year Ending December 31, 1942 DURING 1942 OUR INCOME WAS AS FOLLOWS:- From the Sale of Aircraft and Aircraft Parts ..................................................$337,556,000.17 From Other Sources .........................................................................................$1,532,041.41 This gave us a Total Income of.......................................................................$339,088,041.58 OUT OF THIS AMOUNT WE SPENT:- For Personal Services of Employees (Wages and Salaries), Materials, Sub-contracting, Special Tools, Manufacturing Expenses................................$297,122,061.12 For Interest on Money Borrowed, Depreciation, Expenses of Rented Properties and General Expenses.........................................$4,638,331.19 These Expenses Totaled..................................................................................$301,760,392.31 TO THEM MUST BE ADDED THE AMOUNT WE HAVE SET ASIDE FOR A "RAINY DAY"................................................$3,000,000.00 Bringing the Total to.........................................................................................$304,760,392.31 AFTER THE FOREGOING EXPENSES AND RESERVES HAD BEEN DEDUCTED, WE HAD LEFT THE SUM OF.......................................$34,327,649.27 BUT-OUT OF THIS AMOUNT WE HAVE SET UP A RESERVE FOR FEDERAL AND STATE INCOME TAXES TO BE PAID......................$27,668,840.26 WHICH LEFT US A NET INCOME OF............................................................$6,658,809.01 OUT OF THIS NET INCOME WE PAID OUR STOCKHOLDERS, ON DECEMBER 21, 1942, A DIVIDEND IN THE AMOUNT OF...................$1,651,738.50 LEAVING THE COMPANY $5,007,070.51 WHICH WAS RE-INVESTED IN THE BUSINESS  Against every dollar taken in by The Glenn L. Martin Company, there must be charged the costs of manufacturing, taxes and a wide variety of other expenses. Here's what becomes of a typical Martin dollar in the operation of the Company. PAYROLL This portion of the "dollar" represents the amount paid out directly by the Company in wages and salaries to employees on the Martin payroll. During 1942, Martin employees actually received a total of $117,722,061.96 but only approximately $105,000,000.00 shows on 1942 expense. This is because many airplanes on which employees worked were not finished at the end of the year and went on 1943 business. MATERIAL This is the part of the "dollar" that was spent for Material of all kinds with which we build the airplanes we sell.Without Material none of us can work. It includes the cost of raw and semi-finished Material and some of the finished Material which goes not only into the planes but into the jigs, tools and fixtures used in building them. Included also in Material are many subcontracted items-sub-assemblies and small parts, even down to bolts, nuts, rivets and screws. SUBCONTRACTED MAJOR PART This portion of the "dollar" represents the cost of major parts of Martin bombers now being built by other companies under subcontracts. Included in this cost is not only the material from which these subcontracted major parts are made, but the wages and salaries paid their employees by the subcontracting companies. From this it is plain to see that the total cost of labor in the manufacture of Martin bombers is even greater than that shown in the "Payroll" segment.  TAXES Like all companies we pay taxes of all kinds. These taxes help pay for all public services, and Federal taxes, of course, go not only toward running the country but toward meeting the cost of waging the war. On the second page is shown the amount paid in 1942 for Federal and State Income taxes. Those, however, are only part of the taxes represented by this part of the "dollar." Some of the others are Social Security taxes, Municipal, County and State real estate and personal property taxes and Federal capital stock taxes. In 1942, the Company paid out in taxes $4.85 for every $1 of its Net Earnings. In other words, taxes were 4.85 times total Net Earnings. OTHER EXPENSES while Payroll, Material, Subcontracting of Major Parts and Taxes represent the principal items of cost, there are many other expenses in the operation of the Company. These expenses include, among other things, supplies used in the factories and the offices, general expenses such as advertising, contributions to Community Fund, Red Cross and other charities, postage, telephone, telegraph, heat and light, depreciation of plant and equipment and interest on money borrowed. RESERVE Due to the many problems faced by the Company, not only during the war but also in the post-war period, a reserve has been set aside against the cost of presently unforeseen contingencies. In other words, following standard business practice, the Company has set aside a portion of its funds for a "rainy day". EARNINGS After all expenses, taxes, and reserves have been paid or set aside, the remainder represents Net Earnings which are further divided in two parts as follows: 1. TO STOCKHOLDERS went less than one-half of one per cent of the Martin "dollar" in 1942. These stockholders come from every walk of life. They are people you know. Some of them are your fellow employees, others are your friends, the business men with whom you trade. They are men and women, fathers and mothers-people who have saved money and invested it in the Company because they thought it was sound and would pay them a return on their investment. During 1942 they received approximately one-fourth of Net Earnings. 2. REINVESTED in the business in 1942 to make it stronger and sounder were approximately three-fourths of Net Earnings-about one and one-half per cent of the Martin "dollar". No company can stand still; it must forge ahead further developing its organization and products and, in periods such as we are now passing through, increasing its facilities to meet the demands of our nation at war. To do all these things, it must plow back into the business a substantial part of its Net Earnings. That is what the Glenn L. Martin Company has done for 34 years. IN THE YEAR 1942 For every share of stock outstanding, the Company paid to employees in wages and salaries the sum of $106.34. For every share of stock outstanding, the Company paid out in Taxes the sum of $29.18. On every share of stock outstanding, the Company paid out $1.50 in dividends. |